The majority of retail payments are made with bank cards and therefore it is of crucial importance to have a good point of sale (POS) for restaurants, cafes, shops and other businesses. No matter if you are a small business or a big, established brand, you have to be able to take payments in a most convenient way for your customers. And a credit card is something that no one leaves their home without, despite the rise in card not present transactions.

The use of cash payments is declining in modern countries, and credit card payments aren’t even the only option anymore. More and more people are getting accustomed to mobile device payments’ convenience, be it Apple Pay/Google pay or other providers that operate primarily via a payment link that will accept payments online. When you do not offer your customers an option that can accept debit card payments, customers may leave your business without any purchase. Still, the convenience of payment solutions may raise client satisfaction considerably as opposed to the traditional use of debit cards or other card transactions.

Where can you rent a point of sale (POS) card terminal?

To start to take and process payments, you need to sign the agreement with a local bank or other relevant institution and select the suitable card terminal for your business tied with your business bank account. Comparing banks with other financial institutions offering card payment terminals then banks usually ask a somewhat smaller percentage from your sales/credit card processing fees. Still, other institutions may offer a quicker transfer of money to your account. Each company, of course, has to make the final decision by itself about the most relevant solutions when deciding their merchant account provider for its business. Card processing must be easy for the merchant services also. It’s not just valuable for your customers.

Types of POS card terminals

There are different types of card terminals available. One can divide the POS card terminals into three main categories:

Mobile card terminal

Mobile card terminal suits mainly the companies with a stable sales point but the waiters need to move around, i.e., restaurants and cafes where you serve at the tables can benefit immensely from the implementation of a portable credit card machine.

Smart terminal

A smart terminal suits the companies that do not need to take too many payments per day. The terminal works in a set with a smart device with an internet connection, and therefore the speed of the transactions can be pretty slow. It suits you in case you have a maximum of 30 card payments per day.

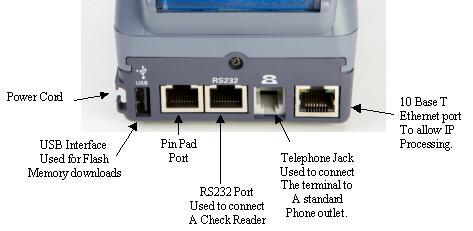

Card terminals with LAN connection

A LAN-connected pin pad card terminal is connected with an internet cable, and it can be integrated with your POS system. This solution suits best for the small business owners that have a stable sales point and many transactions per day.

Which card terminal operates as the best credit card machine?

POS card terminal is the most favourable because it depends on the company’s type, the number of card payments in a day, and their sums.

The price of POS card terminal

The price of usage of a bank card terminal depends on two factors: rent or purchase price and monthly fee paid to a bank or other financial institution. We recommend you rent the terminal and not buy as then it is easy to change the terminal when new functionalities are added (such as Apple pay, mobile payments, or swipe-to-pay) and be up to date. You do not need to purchase a new terminal in the situations like that – you’ll always have the latest updates allowing you to stand toe-to-toe with the best credit card readers on the market.

Fees of a POS card terminal

When it comes to fees, banks and other financial institutions usually take a percentage of each card payment in the form of transaction fees. It might be a problem for a small business, but think about how it will enhance your customers experience through contactless payment.

Here you’ll have to pay attention to the service providers’ different pricing models – in some cases, the percentage is higher, but the maximum amount per one payment is fixed. To find the best solution for the business, ask for comparable offers from different service providers.

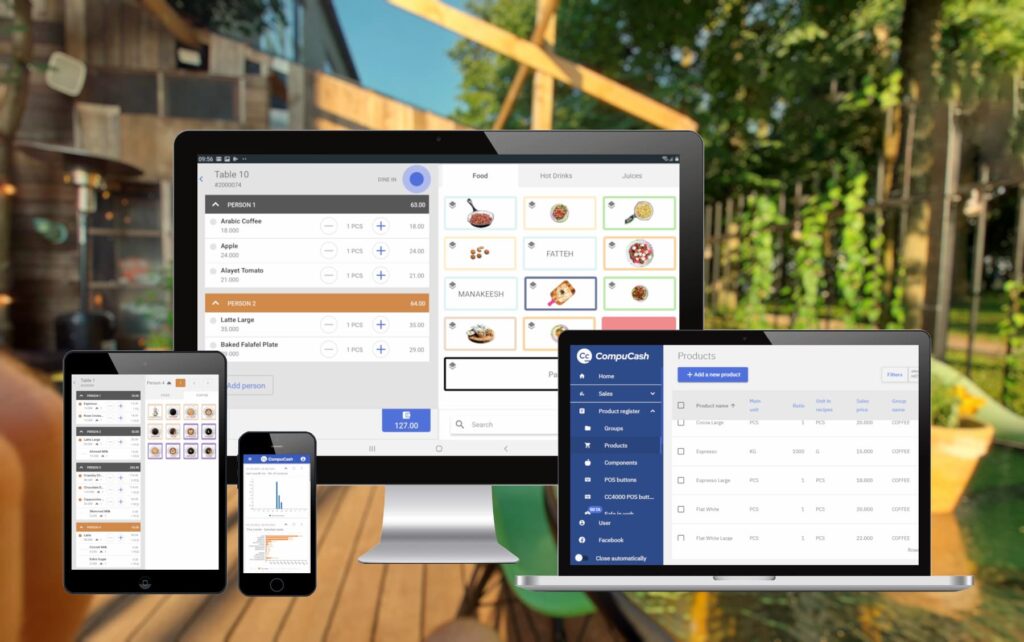

We can offer our ComuCash POS software and complete maintenance package. There are no hidden costs or expensive licenses, making it a valuable payment method option also for small businesses feeling overwhelmed by the deluge of credit card readers available on the market.

Why is it necessary to integrate your POS with credit card machines?

One can integrate the LAN-connected card terminals with POS systems, and we recommend doing it. Theoretically, one can also connect a Bluetooth-connected card terminal with the POS system, but then the POS system cannot be used for other actions while one person is making a card payment. Besides, there is a big possibility that when reaching a table with the credit card terminal, the transaction is already expired.

Automation

When your card terminal is integrated with your POS system, the sum is sent automatically from the POS system to the card terminal – your salesperson does not need to insert it manually. This makes the sales process quicker, smoother and eliminates possible human errors.

Different payment methods

To be sure that you can serve all clients who wish to pay and accept different payment methods (such as swipe, accepting payments online, Apple Pay, contactless payments, etc.), these functions must be supported by all sides POS system, card terminal, and bank. In some places, the options that still do not accept swipe payments occur only because the POS system is not made ready to receive these.

Benefits of integrating point of sale system with the credit card payments

Increased speed of transaction

One of the benefits of a credit card machine for your business is the increased speed of a transaction. In an integrated point of sales with a credit card machine, the time per one sale is decreased by more than 50%. How does it work? A seller will click the card payment button in its point of sale system, and there will appear the text ‘waiting for the card.’ A client will insert her/his card into the payment terminal, and the sellers can monitor the steps happening on his/her screen. The seller does not need to insert the sum to be paid separately as it happens automatically.

We have calculated that this saves 3-5 seconds per transaction and so per 200 transactions. It means already 1000 seconds of a win for a business, i.e., 15 minutes of extra time you can earn additional money, especially at rush hours.

One can also use swipe payments to speed it even more – it takes just one swipe to get it paid. Small lunch and drink payments can mostly be made that way as the sums per transaction stay below the limits of swipe payments settled. This is very convenient both for the customer and the salesperson.

Reduction of human error

The second benefit is the reduction of human error. How does it happen? While a seller has to type the sum to be paid by hand into the card reader in a rush or tired, instead of 10 euros, only one gets inserted. This is unfortunate, but it sometimes happens. At the end of the sellers shift, the mistake comes out, but one cannot get the client’s missing money anymore, and it takes time to find out where the error came from. To help with that, integrate the credit card machines and sales systems. An integrated payment terminal and point of sales do not allow these mistakes to happen, helping save money in the the long term and easing any employee management issues.

How do you choose a suitable credit card machine?

A credit card is a convenient way for paying for different services and items, both for the customers and the salespeople. So you can make the sales process and customer experience so much better by just providing expected payment methods. Especially for small businesses, that are just starting out, an easy to use credit card machine for providing fast card processing is a must, as it is a part of overall customer experience.

When choosing a best POS system in uae, the best option is to go with solutions that have a simple design. You don’t want to take the time for extensive tutorials or have your salespeople spend their valuable time learning the new system. Your time should be spent taking care of your business. As with all IT-related services, having support that is available quickly over the phone is a must.

When opting for an integrated system, make sure that there is offline availability as well. This way, if you happen to have internet connection issues, your daily operations remain uninterrupted.

With our simple and straightforward CompuCash system, you can manage the range of different mobile and credit card payments with ease—your business benefits from improved efficiency, eliminated errors, and improved customer experience.

Looking for a Delivery Integrated Point of Sale solution?

Ask our specialist Marc for more info +971 50 566 5278 or write [email protected]